Tag: Homeowner’s Insurance

-

Home Security Upgrades That Could Save You Money on Insurance

Homeowners insurance is an essential safety net that helps protect your property from unexpected events like theft, fire, or natural disasters. However, premiums can be expensive, and many homeowners are looking for ways to reduce their monthly or yearly payments. One effective method to lower insurance costs is by upgrading your home security. Insurers often…

-

How to Prevent Common Household Accidents and Lower Your Insurance Premiums

Accidents in the home can be both physically and financially devastating. From slips and falls to fires and water damage, these incidents can result in significant medical bills, repairs, and increased insurance premiums. However, many of these accidents can be prevented by taking simple precautions and maintaining a safe living environment. Additionally, by reducing the…

-

Renters vs. Homeowners Insurance: What’s the Difference and Why It Matters

When it comes to protecting your property and belongings, insurance is essential. Whether you rent or own your home, having the right insurance coverage can give you peace of mind in case of unexpected events like fires, theft, or natural disasters. However, the insurance policies available to renters and homeowners differ significantly. Understanding these differences…

-

How to Choose the Right Home Insurance Policy for Your Family’s Needs

Home insurance is one of the most important investments you can make to protect your family and property. A good home insurance policy not only safeguards your home against natural disasters and accidents but also provides financial security in the event of theft, fire, or other unforeseen circumstances. However, with so many options available, choosing…

-

Is Your Home Insurance Up-to-Date? Why Regular Policy Reviews Matter

Home insurance is one of the most important financial tools to protect your home, belongings, and loved ones from unexpected events. However, it’s easy to assume that once you’ve signed up for a policy, you’re covered for life. The truth is, your home insurance needs evolve over time, and failing to keep your policy up-to-date…

-

What Home Insurance Doesn’t Cover: Avoiding Common Surprises

When it comes to protecting your home, home insurance is a must-have. It provides financial security in the event of accidents, damage, or theft, ensuring that you’re not left with overwhelming costs to repair or replace your property. However, while home insurance covers a wide range of risks, there are several things that it typically…

-

Home Insurance Claim: Step-by-Step Guide

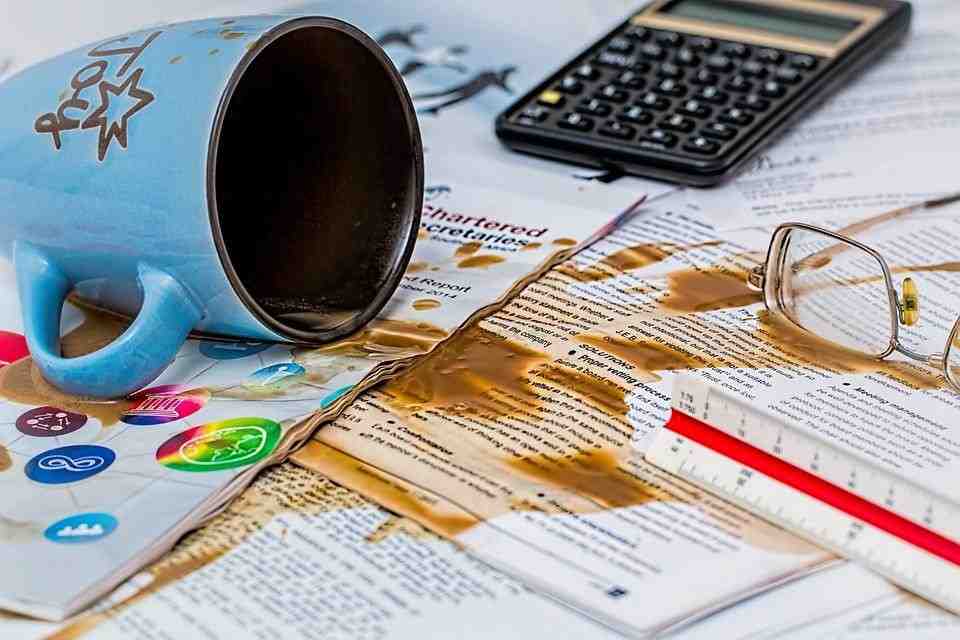

Filing a home insurance claim can be a stressful and overwhelming process, but knowing what to do can make the experience smoother and help ensure you get the compensation you’re entitled to. Whether your property has been damaged by fire, flood, theft, or a natural disaster, following these steps will guide you through the claim…

-

Water Damage vs. Flood Insurance: What’s the Difference?

When it comes to protecting your home or business from water-related damage, it’s crucial to understand the differences between water damage insurance and flood insurance. Although both policies deal with water-related incidents, they provide coverage for distinct types of damage. To ensure you’re adequately covered, let’s break down the key differences between the two. Water…

-

Luxury Additions and Insurance: Pool, Solar Panels, and More

In recent years, homeowners have increasingly invested in luxury additions to enhance their property’s value, utility, and aesthetic appeal. From shimmering backyard pools to cutting-edge solar panels, these upgrades can transform a home into a sanctuary of modern comfort and eco-conscious living. However, with luxury comes responsibility, particularly when it comes to insurance. Understanding how…